Moneywiz 1 4 1 – Personal Finance Solution

MoneyWiz 3 Icon | |

| Original author(s) | Iliya Yordanov[1] |

|---|---|

| Developer(s) | SILVERWIZ LLC |

| Stable release | |

| Operating system | macOS, iOS, Windows, Android |

| Available in | English, Chinese, Russian, Portuguese, Spanish, Japanese, Korean, Italian, French, Polish, German, Swedish, Czech, Romanian, Indonesian, Ukrainian, Hungarian, Catalan, Dutch, Turkish, Bulgarian. |

| Website | https://wiz.money |

MoneyWiz is a money management application that runs on Microsoft Windows, Google's Android, and Apple platforms including iOS and macOS. MoneyWiz is developed by SilverWiz[3] and is the top selling personal finance app outside of the United States as well as a Top 10 Finance App on the U.S. App Store.[1][citation needed] MoneyWiz has received awards and recognition which include being named the Best Finance App out of the Top 500 Must Have Apps by The Telegraph.[4] It was named a Sleek Personal Finance App by Macworld[5] and rated as one of the Top 5 Best New Year's Resolution Apps for iPhone and iPad in 2012.[6]

Recognized by Forbes, CNN, The Telegraph, The Independent and more! MoneyWiz is the ULTIMATE finance management application loved by thousands! We have it all:. worldwide online banking support with automatic transaction categorization and access to over 16,000 banks in over 50 countries,. crypt.

- MoneyWiz 2.5.1 – Personal finance solution. October 31, 2016 MoneyWiz can simplify your financial life by keeping all your accounts, budgets and bills in one place, plus powerful reports, worldwide online banking, and instant sync between all your devices!

- MoneyWiz is a cross-platform personal finance app for iOS, Mac, Android, and Windows. It integrates three major aspects of personal finance into one app: managing accounts, budgets, and bills. By integrating all three aspects, we're able to provide customers a seamless flow of their financial data, making it easier for them to see the big.

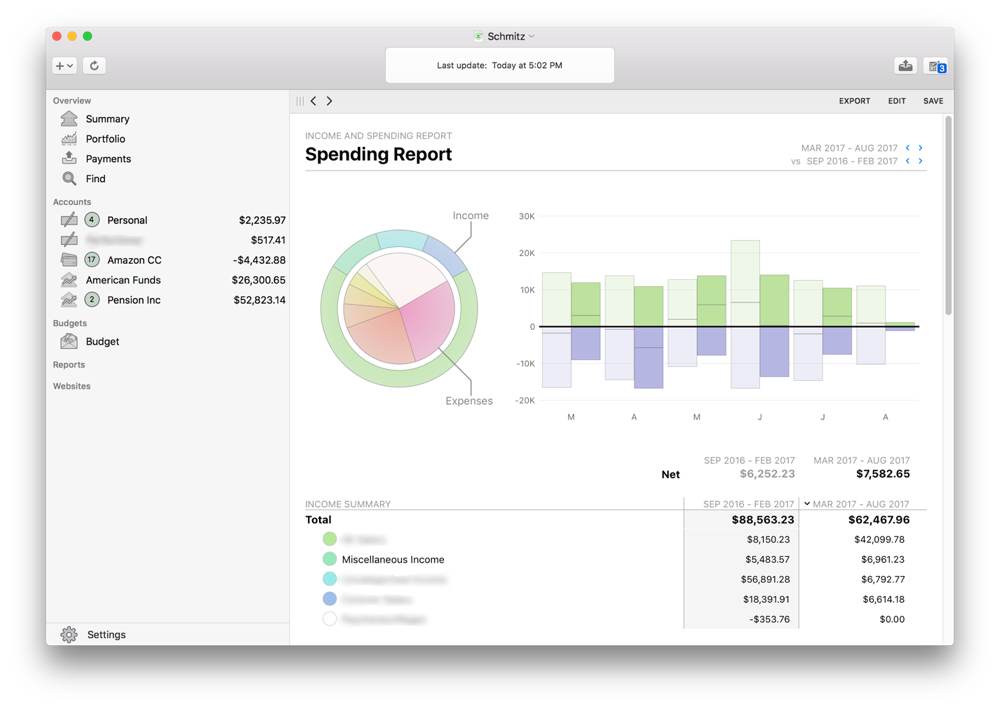

MoneyWiz tracks income and expenses as well as allowing users to set and track budgets. It has the ability to schedule payments and also create reports based on the information input by the user.[7] The app also has its own syncing platform referred to as 'SYNCbits' which syncs a user's information to any device in which the app is installed.[3] MoneyWiz supports twenty languages and is said to comply with the financial system in the countries where the official language is one of the supported ones.[8]

SYNCbits technology[edit]

When the company was founded in 2010, the developers of MoneyWiz were the first to create a cloud sync solution for the kind of data used in databases, as opposed to file cloud sync. The technology is called SYNCbits and is considered to be the most reliable (in terms of uptime, security and performance) cloud sync available in any finance software.[citation needed]

SYNCbits uses backdoor-free 256 bit encryption, meaning that the data is nearly impossible to be decrypted without knowing one's password or security answers.

Online Banking (bank sync)[edit]

MoneyWiz connects to over 16,000 banks in over 51 countries around the world, to allow its users to download & categorize new transactions automatically.[9] While traditional finance apps, such as Mint would only use one data aggregation platform to provide the bank sync, MoneyWiz is the first (and currently only) finance software that uses two data providers simultaneously. That allows it to support more banks in more countries than other finance apps.

See also[edit]

References[edit]

Moneywiz Apk

- ^ ab'27 Year Old Developer Strikes Gold Again With His 4th Startup: SilverWiz'. Mac Community News. 13 March 2013. Retrieved 30 May 2013.Cite has empty unknown parameter:

coauthors=(help) - ^'MoneyWiz 2 - Personal Finance on the App Store on iTunes'. App Store. February 2, 2015. Retrieved 2017-11-21.

- ^ abBernhard, Todd (26 April 2013). 'Money Talks: SilverWiz Shares Secrets Of Its Breakout Finance App, MoneyWiz'. iPhone Life Magazine. Retrieved 30 May 2013.Cite has empty unknown parameter:

coauthors=(help) - ^500 Must-Have Apps. The Telegraph.

- ^Wilhide, Brendan (5 September 2012). 'MoneyWiz A Sleek Personal Finance App'. Mac World. Retrieved 4 June 2013.Cite has empty unknown parameter:

coauthors=(help) - ^Lofte, Leanna (1 January 2012). 'Top 5 Best New Year's Resolution Apps For iPhone and iPad'. iMore. Retrieved 30 May 2013.Cite has empty unknown parameter:

coauthors=(help) - ^Hornshaw, Phil (24 October 2011). 'Fresh iPhone Apps For Oct. 24'. Appolicious Advisor. Retrieved 30 May 2013.Cite has empty unknown parameter:

coauthors=(help) - ^Spencer, Graham (10 October 2012). 'Behind The App: MoneyWiz'. Mac Stories. Retrieved 30 May 2013.Cite has empty unknown parameter:

coauthors=(help) - ^'Become a personal finance wiz this new year with MoneyWiz 2 for iPhone and iPad'. AppAdvice. 2015-01-01. Retrieved 2018-02-16.

External links[edit]

Amazon Cloud Drive launched its developer platform a year and a half ago, and more recently the Android and iOS SDKs. Since then the Cloud Drive API has enabled companies to connect with new customers by providing them with instant access to data and functionality they would have otherwise needed to build.

By leveraging the Amazon Cloud Drive developer tools, companies can focus on building new customer experiences and differentiated product offerings without the hassle of setup or the need to maintain their own storage back end. This gives the Amazon developer community a way to add Amazon Cloud Drive’s unlimited storage to their apps so their customers can save, view and manage their files from anywhere. Photography and productivity apps are popular third-party developer integrations, allowing customers to do anything from editing their photos and documents to backing up all their files. More recently, financial technology companies are using Amazon Cloud Drive to store and sync receipts, which improves convenience for customers looking to manage their personal finances.

Today, we’ll look at the 4.5+ star-rated personal finance app MoneyWiz and sit down with Iliya Yordanov, Founder and CEO of SilverWiz, to learn about how his company is using Amazon Cloud Drive in their cross-platform app to help customers better manage their money.

Tell us about your company?

SilverWiz started in 2010 to solve a personal problem I had by building a powerful personal finance app to help me better manage my money. In June of 2011, we launched our first app and have since grown our customer base to over one million users. Our distributed team has also grown over the years to twelve people. We are headquartered in San Francisco, CA, and our company is 100% self-funded.

What does MoneyWiz do and how does it simplify personal finance?

MoneyWiz is a cross-platform personal finance app for iOS, Mac, Android, and Windows. It integrates three major aspects of personal finance into one app: managing accounts, budgets, and bills. By integrating all three aspects, we're able to provide customers a seamless flow of their financial data, making it easier for them to see the big picture of their money. MoneyWiz is not a typical finance app where customers just input an expense amount and fool themselves that they’re responsible with managing their money. Our software has more than 400 features and really lets customers dig in and manage their money. Some of the most popular ones are online banking, multi-device sync across platforms, and forecasting capabilities. On top of that, we've spent thousands of hours optimizing MoneyWiz so it's intuitive for the majority of people, getting the learning curve down to just a few minutes.

How do you think about consumer cloud storage as it relates to personal finance?

Historically, personal finance software hasn't been using cloud storage much. MoneyWiz was actually the first personal finance app to be cloud capable, providing automatic seamless sync between any number of devices. Now with cloud file storage, we can take that to a whole new level.

Explain your Amazon Cloud Drive API integration?

What we've developed for MoneyWiz using the Amazon Cloud Drive API is a receipts sync and backup feature. This lets MoneyWiz users attach photo receipts to their expenses. Our sync platform, SYNCbits, is dedicated to syncing data rather than files and for that reason we didn't have receipts sync up until now. Whenever a customer attaches a photo receipt to a transaction, we use the Amazon Cloud Drive API to upload it to their account in a folder named MoneyWiz. Then all instances of MoneyWiz detect the newly uploaded photo receipt and download it. It's completely automatic and allows our customers to have all of their receipts synced between all of their devices thanks to Amazon Cloud Drive. The Amazon Cloud Drive API integration makes this customer experience possible.

What developer tools did you use to implement receipts sync?

We used Android Studio together with the Amazon Cloud Drive Android SDK and specifically Login with Amazon, List Nodes, and the Upload and Download File features. Receipt sync takes place at the time customers save a transaction that has a receipt attached to it, assuming other conditions are met. For example, if a customer has disabled non-WiFi receipts sync, MoneyWiz will wait for WiFi before it syncs to avoid high data usage costs. We also reviewed the Amazon Cloud Drive demos, documentation, and best practices guide to deliver an outstanding customer experience.

What platforms is Amazon Cloud Drive supported on in your app?

As of today we’ve completed the integration on Android for the Amazon Appstore version of MoneyWiz. Kindle Fire users can search the Amazon Appstore for MoneyWiz and connect their Amazon Cloud Drive account to enable receipts sync. Over time, we will roll out the receipts sync feature across other platforms we support.

How do Amazon Cloud Drive customers get started?

Customers can download MoneyWiz on their Kindle Fire device, by searching for MoneyWiz, or get it directly through the Amazon Appstore. If they want to download it on other devices (iOS, Mac, Windows) they can visit the MoneyWiz website for download links.

How do customers enable receipts sync using their Amazon Cloud Drive account?

Once customers download MoneyWiz from the Amazon Appstore, they can go into the app’s Settings, and select SYNCbits. (Customers will need to register for a SYNCbits account if they don’t already have one to allow us to sync the receipts’ metadata.) Once customers are logged in to SYNCbits, a new button will appear that allows customers to link MoneyWiz to their Amazon Cloud Drive account. Once they link Amazon Cloud Drive, receipts sync is enabled and will automatically run in the background.

How can other financial companies leverage consumer cloud storage such as Amazon Cloud Drive?

Most financial companies that develop apps (not web based services) don't provide any sync capabilities at all, so Amazon Cloud Drive could be a great start for them. For example, our team wants to expand the file syncing capabilities to several other aspects of our service, such as saving reports and automatic local backups of the database. We're also considering export sync to allow seamless integration with other financial tools.

How quick was it to get started with the Amazon Cloud Drive developer tools in comparison to other cloud storage platforms?

On a technical side there were no surprises. The step-by-step tutorials and samples made getting started with the Amazon Cloud Drive API extremely easy. We had a minor hiccup with the proper signatures for authentication, but the Cloud Drive support team was very responsive and helpful in identifying the error on our end and provided a solution to correct it. Other than that, I must say that the whole integration process was pretty easy and straightforward.

Moneywiz Download

Lastly, where do you envision personal finance going in the next three to five years?

I closely monitor the FinTech industry and it's a very dynamic one. FinTech is booming right now with startups offering all sorts of personal finance solutions, but most are targeted to solve just one issue. I believe that in time we'll see distinct leaders who can solve those single issues but solve them well. From a customer's perspective, I believe people will gain better understanding of their finances and be more equipped to automate financial tasks. We're actually working towards this, too, but at the moment I am unable to provide more details. There are lots of changes going on in the industry and the space will look entirely different in three to five years.

Support Amazon Cloud Drive in Your Finance App

If you’re interested in supporting Cloud Drive in your finance app, please email clouddrive-finance-api@amazon.com. Click the links below to learn more:

- Learn more about the Amazon Cloud Drive API

- Check out the Amazon Cloud Drive Android and iOS SDKs

- Sign up for a free 3 month trial of Amazon Cloud Drive